Calculate diminishing value depreciation rate

These are Straight-line depreciation and Diminishing balance method of depreciation. The results of this depreciation rate finder and calculator are based upon the.

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Calculation Explained With Example

Assets cost days held 365 200 assets effective life The decline in value for 202122 is 602 worked out as follows.

. The formula for the annual decline in value using the diminishing value method is. The straight line method SL. There are 2 methods for depreciation.

Each year you claim for the item the base value reduces by that amount. The template displays the depreciation rate for the straight-line method based on scrap value. Base value days held 365 200 asset.

Firstly determine the fixed cost of production incurred during the given period including salary depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Improving real estate increases its value up to a point but eventually improvements may offer. Calculate the Salvage value of the machinery after 10 years.

And if you want to calculate depreciation rate percentage manually then. For the next of years we apply the same percentage on the booked of written down value of the asset but the value of the percentage is not given in the data we. The asset cost 2000 and youll be able to sell it for 500 when youre through with using it.

The formula used to calculate this method is. Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method. You calculate the decline in value of a depreciating asset using either the.

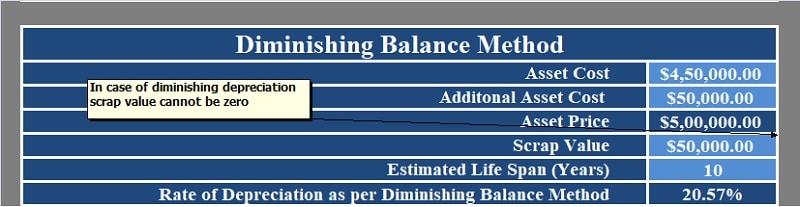

For any items valued at less than 300 you can claim 100 of the value of the item immediately. Depreciation Calculator is a ready-to-use excel template to calculate Straight-Line as well as Diminishing Balance Depreciation on TangibleFixed Assets. Work out diminishing value depreciation.

Suppose a customer takes a housing loan for Rs40 lakh with 10 interest rate. The formula for the Reducing Balance Method can be represented as Amount of interest for each installment Applicable rate of interest Remaining loan amount. These are expenses that do not affect the cash flow of a given period.

The depreciation rate percentage is applied on reducing balance of asset. New Productivity 1333 pieces per Labor Therefore SDF Ltds marginal product of a labor of the new workforce is 2000 pieces per labor that has resulted in an increase in the productivity of the entire team from 1250 pieces per labor to 1333 pieces per labor. The monthly EMI becomes Rs38601.

In Straight-line depreciation fixed amount of depreciation is followed whereas in Diminishing balance a fixed rate is followed and the amount of depreciation decreases along. Calculate the Average Cost Per Equivalent Unit Once all the costs have been identified for each process then its a simple process to calculate the average cost per unit. Foreign exchange contracts are reported at fair value as on the reporting date.

Moreover it displays the year on year amount of depreciation for as per the Diminishing Balance. Laura is entitled to a deduction for decline in value of 600. Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25.

The diminishing value formula is as follows. A diminishing value calculation assumes the asset depreciates quicker at the start of its life so you claim more in the beginning than in subsequent years. Diminishing Value Depreciation Method.

We can calculate it by following these five steps. Suppose a photocopier has a useful life of three years. All of these costs from each process are added together to get one total cost and this value is then divided by the total equivalent unit number to get the average.

Written Down Value Method Formula. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. You have to divide the number 1 by the number of years iover which you will depreciate your assets.

2000 - 500 x 30 percent. After 9 years scrap value 100000 90000 10000. Related Topic More Assets Related Questions and Answers How to Calculate Scrap Value of an Asset with WDV Depreciation.

The diminishing value method DV This method depreciates at a high rate for the start of an assets life and has a reducing rate each year. If you buy a computer that you expect to use for five years then all you need to divide 2 into 1 to attain a depreciation rate of 02 per year. In this method we apply a percentage on face value to calculate the Depreciation Expenses during the first year of its useful life.

The principle of increasing and diminishing returns is related to the principle of balance. To Calculate Scrap Value of an Asset Cost of Asset Total Depreciation. All College Subjects covered - Accounting Finance Economics Statistics Engineering Computer Science Management Maths Science.

Export the calculation results to an Excel workbook. Written Down or Diminishing Balance Method. If an asset costs 50000 and has an effective life of 10 years your first years.

The difference in the value of accounting depreciation and economic depreciation should be adjusted from the capital employed. The total depreciation you can claim over an assets life is the same for both methods. Get your Homework Questions Answered at Transtutors in as little as 4 Hours.

The adjustable value of the asset on. The rate of depreciation is 30 percent. MobilePortable Computers including laptops and tablets effective life of 2 years from 1 July 2016 Under the depreciation formula this converts to a Diminishing Value percentage rate of 100 or Prime Cost 50.

Its value indicates. Base value x days held 365 x 200 assets effective life Example. Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100 Diminishing balance or Written down value or Reducing balance Method Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset.

Colin elects to calculate the decline in value of his computer using the diminishing value method. How to calculate decline in value. View the calculation of any gain or loss on sale on the disposal of an asset when appropriate.

Diminishing value method. Using the fixed rate method for the period 1 July 2019 to 28 February 2020. Base value days held see note 365.

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Cash Flow Statement Templates

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Download Cagr Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculation

Written Down Value Method Of Depreciation Calculation

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

How To Calculate Depreciation Using The Reducing Balance Method In Excel Youtube

Depreciation Methods Principlesofaccounting Com